AP Automation & Machine Learning: Finance Game Changers

Produced by our content partners and reviewed by Envoice’s internal experts to ensure it reflects real accounting workflows and accurate product usage.

If you’re in finance, we don’t need to tell you how painful the accounts payable processes can be at times. It’s long been in need of an overhaul, and finally, that era has arrived.

With the help of AP automation solutions, accounts payable looks nothing like it did a few short years ago. Faster invoice processing times, more early payment discounts, and a significant reduction in manual data entry are already making a positive impact. And the future for finance teams? It’s starting to look a whole lot brighter and more interesting.

So what’s behind all the fuss, and more importantly, is it working out for businesses that have already incorporated accounts payable automation into their processes? That’s what we’re here to find out by hearing directly from companies that have implemented AP automation systems in their businesses.

Why AP automation and machine learning are changing the game

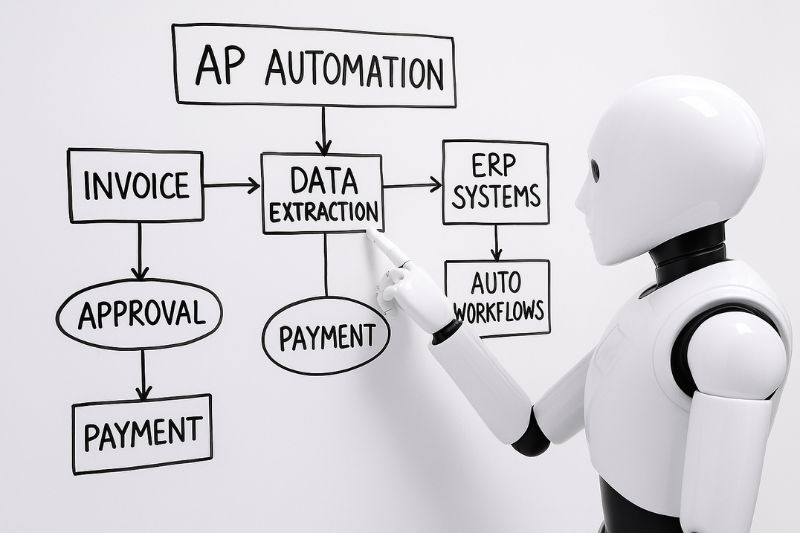

In a nutshell, AP automation and machine learning are changing the way invoice data is processed.

With technology rapidly evolving due to artificial intelligence, accounting documentation, once manually processed, is now rapidly dissected and categorized by machines. This technology is not exactly in its infancy, but many still wonder if manual data entry can be replaced. The answer is: It already has – and it’s doing a great job!

1. Reduction in processing times and costs

Automation has reduced invoice capture and processing time from 7-14 days to 3-4 days, and lowered the cost from $15 per invoice to $4.84.

How has automation accomplished this, you may ask? Rather than human intervention or by using physical robots, robotic process automation uses bots to automate repetitive manual tasks such as reading invoice data, matching purchase orders, and approval routing.

The benefit of this faster process is that your team sees a live dashboard that continually updates them on the progress of invoices, without any physical contact with paperwork. It’s all neatly processed by the automation software and securely stored in a central location without any manual handling. Tight security protocols for these tools ensure your sensitive financial data doesn’t end up in the wrong hands.

If you’re dipping your toe into AI and machine learning waters for the first time, then the resources: AP Automation – All you need to know and Invoice Recognition Software For New Users in 2025 are a good starting point for understanding how this technology works.

2. Automatic data extraction and greater internal controls

Machine learning, on the other hand, makes this process even more powerful.

It learns (by optical character recognition) your vendor’s specific invoice format based on historical data, predicts the correct GL codes, flags duplicate invoices before they get processed, and flags data that is out of the usual pattern for a specific client, long before you’ve noticed there’s a problem.

It’s like giving your team a digital investigator, analyst, and superhuman data processor – and it never gets tired or misses a beat.

3. Analysis of historical data for smarter decisions

This is where the real strength of both automation and machine learning (ML) becomes clear. When machines can analyze historical invoice data, you have a powerful way to predict the outcomes at every point of your AP process.

The ability to view data in real-time (due to synchronisation with other financial systems) provides your finance team with credible and accurate historical payment data, which they need to manage cash flow and make data-driven decisions that can streamline operations overnight.

Fortunately, the results speak for themselves through customer case studies and data-driven studies.

Customers in Action: Real-life case studies for automation and ML

Customer A – Saving hours of administrative work every day

The challenge:

The customer faced the need to hire twice the number of accountants to process the work generated by their 800+ global clients. They wanted one streamlined process to get the job done despite having clients in 120 countries.

Manual processing of invoices and receipts was time-consuming, and not a challenge for the accountants, who were better suited to strategic financial management. With their operational efficiency at stake, they envisioned a system that could reduce human intervention to zero while greatly increasing their cash flow management.

The solution:

A robust automation tool that revolutionized the company workflow, saving hours of processing and accelerating turnaround time. They had the ability to store documents from a diverse client base arriving from multiple sources, as well as centralize the archiving of documents. Through the use of artificial intelligence (AI), they were able to simplify their entire process. Complete digital transformation was achieved.

The result:

A 40% annual growth was achieved as a direct result of using OCR technology to streamline their financial processes and ensure optimal compliance with internal financial regulations. Their team now saves several hours daily thanks to Envoice’s ML-powered invoice processing and data extraction, which automatically captures, classifies, and posts invoice data into their ERP systems.

If you have the same problem, then the same solution can work for your business. Over 10,000 users have found that Envoice works for them, and now they can help you too. Sign up for a free trial or book a demo to see automation in action.

Customer B – Managing approvals from anywhere

The challenge:

The customer had only two people working on the AP process and trying to manage the company’s AP operations. They were responsible for manually matching invoices, including both local and international ones. The finance department was stretched to say the least.

Furthermore, the software they were using was not performing efficiently enough because it still required the finance department to manually attach PDF files to documents. This customer needed a digital transformation that would ensure real-time data processing and seamless approval routing.

The solution:

The use of automated systems, such as Envoice, to perform repetitive tasks that were taking too much manual effort. They decided to change their way of processing invoices to allow the software to work even better, and included automated approvals in their workflow.

The result:

The ability to handle large volumes of invoice processing without increasing staff complement, which suits their seasonal work cycles. The future goal of one unified system to automate all pre-accounting without human intervention is now possible. By completely eliminating paper, many errors have been avoided, and invoice validation has become easy.

Interested in learning more about the advanced benefits of invoice automation? Our team of highly skilled automation experts is ready and waiting to answer your questions. Contact us anytime to discuss how Envoice can help.

Customer C – A completely paperless finance environment

The challenge:

The customer had the challenge of managing the invoices of three different dealerships, each with their own processes.

This amounted to around 900 purchase invoices a month. Between the dealerships, a large amount of paperwork was being shuffled around, and approvals were lying in someone’s inbox, awaiting payment. This was far from the ideal situation, which this customer believes is to process accounting documents as quickly as possible to see how it affects the cash flow of the business.

The solution:

They needed visibility. A unified system gave the head of accounting a clear view of total invoices processed and how that impacted cash flow in real time.

They found exactly that with Envoice and began using the demo for two weeks, which they said many other software companies do not offer.

The customer did not want software that costs half the monthly salary of an accountant, and Envoice was the perfect solution for this. With its reasonable pricing and no-risk subscription plans, it became the obvious choice for meeting customer needs.

The result:

A completely paperless finance environment with quick processing times and reasonably priced software that has powerful automation and machine learning capabilities.

The customer appreciated integration with their accounting software and even hopes to use Envoice for sales invoices in the future. The three dealerships are now fully integrated, with automated approval processes in place between management teams, thereby increasing the ability to make timely payments. They also have a powerful way to optimize cash flow with predictive analytics.

Further standout features for this customer:

- Customization capabilities during setup.

- Quick response on improvements, such as the need for comments to be seen before viewing the invoice.

- The user-friendly interface is simple to navigate and control.

- The involvement of accountants in software development ensures that workflows are established according to standard accounting practices.

Secure the same benefits for your own company, even if you have teams in different locations. With Envoice, you can have one unified system that controls all your invoice processing and integrates with your accounting system. Book a demo now.

AP automation and machine learning tech are a must

With the evidence presented by real-life customers, it is clear that accounts payable (AP) has arrived at an interesting juncture where the way forward is automation and ML technology.

AP departments have been struggling to cope under the weight of large volumes of financial transactions for at least two decades. As globalisation made the world smaller, it also created many opportunities for expansion, which the accounting industry didn’t keep pace with.

That has all changed with AI automation software making a huge bid for the accounting field, and succeeding. A survey conducted by Ashish Singh from Galgotias University found that AI significantly improves efficiency and accuracy, while fraud detection capacity increases by 40 percent, and manual intervention decreases by 50 percent. [1]

Tony Sacre, CEO of Allinial Global, had this to say during his talk at the IAFA in 2025.

‘The accounting profession stands at a crossroads. As AI and automation reshape the way firms deliver services, the real challenge isn’t the technology itself; it’s reimagining the role of the accountant.’

He further added that accounting firms that fail to modernize within the next two years will struggle to retain talent, serve clients efficiently, and compete in world markets. [2]

Real-life customers and experts all agree that AP teams will be left wanting if they don’t make the change within 12-24 months. Automation technology enables you to scale your business while leveraging the skills of your accountants and AP team for high-level strategic financial analysis.

If you’re still hesitant to proceed after joining our discussion, then you need clarity for your own business. We understand that. Even if it’s a necessary decision, it can be a tough one, and implementation can seem daunting.

Take your time, consider your options, and ask as many questions as you like. Make use of our free trial to test our software and see for yourself how it works in real-time, enabling businesses to automate their accounting processes. Then take the leap. The time is now.

References:

STAY ALWAYS TUNED

Subscribe to newsletter

Still not sure?

- Don’t spend time on manual work

- Streamline bookkeeping processes with AI

- Automate invoice processing

- Integrate with the tools you rely on every day